Investment Tips

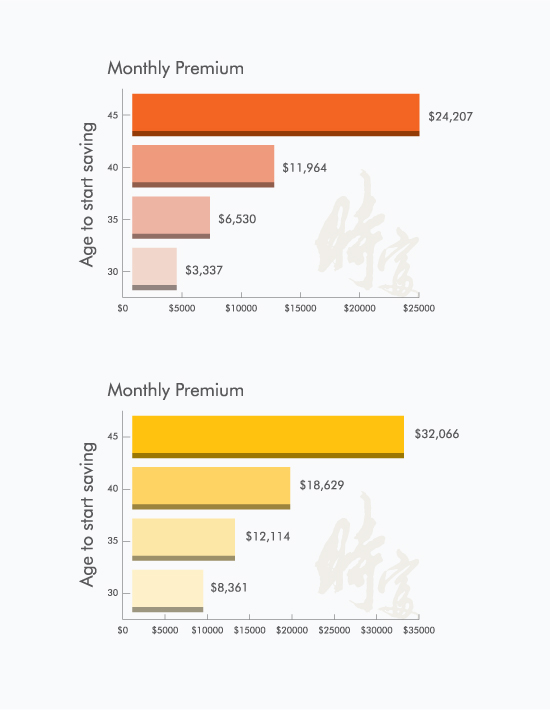

Cost of DelayAchieving an aspirational living standard is not just a dream if you start planning for your retirement ahead of time. In order to reach our retirement goals, most of us would invest periodically with our surplus. However, delaying the planning process requires more capital input in the retirement reserve. Assuming that the goal is to accumulate HK$5,000,000 at the age of 55, the following charts illustrate the monthly investment amount required and the cost of delay:

| Assumed net annual return | 10% | 5% | ||||||

| Age to start planning | 30 | 35 | 40 | 45 | 30 | 35 | 40 | 45 |

| Monthly contribution (HK$) |

3,737 | 6,530 | 11,964 | 24,207 | 8,361 | 12,114 | 18,629 | 32,066 |

| Total contribution (HK$) |

1,121,168 | 1,567,200 | 2,153,500 | 2,904,837 | 2,508,399 | 2,907,355 | 3,353,171 | 3,847,898 |

| Cost of delay (HK$) |

_ | 446,032 | 586,300 | 751,337 | _ | 398,956 | 445,816 | 494,727 |

It is obvious that “the longer the delay, the greater the cost”. So what are you waiting for? If you believe the saying that “money cannot buy you time” then you should also understand the fact that “time can save you money”.

Dollar Cost Averaging

Dollar Cost Averaging (DCA) is a practice of investing the same amount of money at regular intervals, regardless of the price of fund units or shares at the time of purchase. This strategy allows investors to purchase more units while prices are low, and fewer units as prices increase. As a result, the average cost per unit bought will be lower than the average market price in the stock market. DCA helps even out the market price fluctuation to eliminate the need for market timing. Our Mandatory Provident Fund contribution scheme is a good example of an effective DCA scheme.

Copyright@2021 CASH Financial Services Group